We're Patrick & Amie Bowers

Licensed Annuity & LIRP Specialists. Wealth Strategists.

INSULATE YOUR RETIREMENT SAVINGS FROM THE IMPACT OF RISING TAXES & MARKET VOLATILITY.

We're PATRICK & AMIE BOWERS

Licensed Annuity & LIRP Specialists. Wealth Strategists.

INSULATE YOUR RETIREMENT SAVINGS FROM THE IMPACT OF RISING TAXES & MARKET VOLATILITY.

Over 1 Million

Families Helped

$150 Billion

Life Insurance Placed

$800 Million

Premium Sold

10,000+

Professional Agents

Over 1 Million

Families Helped

$150 Billion

Life Insurance Placed

$800 Million

Premium Sold

10,000+

Professional Agents

Fixed Indexed Annuities

Annuities provide a guaranteed income for life. With longevity on the rise, having a safe and guaranteed monthly income source you can count on is no longer a luxury, but a necessity. With indexing, your annuity can participate in the market's gains while avoiding potential losses. Immediate, 3, 5,7, 10, and 15 year options available, as well as flexible premiums that allow for monthly or annual contributions. Many clients choose to ladder multiple annuities in order to have one reaching maturity every other year.

Indexed Universal Life

Indexed Universal policies are permanent policies that serve as the Swiss Army Knife of the financial industry. They provide a lifetime death benefit; a cash accumulation vehicle; a tax-free retirement supplement; a long-term care benefit; and liquidity that allows for the cash value to be accessed and used while still growing within the policy. Max-funded they can be used to create a potent retirement supplement, a college fund, as well as a war chest for business investments.

Mortgage Protection

Mortgage protection insurance protects your family's most important asset (the home) in the event of a death or qualifying disability. Whether covering the mortgage in its entirety to pay it off completely; covering half to set up a reverse mortgage; or covering a year or two of payments in an equity protection product to buy time while getting it fixed up, listed, and sold, mortgage insurance protects against the bank taking an asset that is rightfully yours.

Final Expense

Final Expense insurance is designed to cover you for life with a premium that will never increase and a death benefit that will never decrease. In most cases, we are able to get day one coverage, meaning after approval and making one payment, you are covered for the full face value. No bloodwork or medical visit required. These policies are typically used to. make sure all funeral and other end of life expenses are covered.

Industry's Best Annuity & Insurance Providers

About Us

We are Patrick and Amie Bowers, the founders and owners of Gratitude Financial. When we launched our careers in 1999--Patrick in education, and Amie in the building industry, we had no way of imagining this is where life would take us. But with a love of helping others and for crunching numbers, we found ourselves more and more intrigued by financial services and planning for our future and the futures of our children. We are humbled to say that since establishing Gratitude Financial--with a focus on creating retirement income and helping to preserve, manage, and transfer the wealth of our clients to their heirs--our agency has been able to help protect thousands of families.

Our team works closely with our clients to discuss their financial needs and expectations, then develop a plan based on their individual goals and objectives. We specialize in helping to preserve retirement income, transferring family wealth, tax planning, estate planning, life insurance premium financing, business succession, and retirement planning.

We live in San Diego, CA. When we aren't at the office, we enjoy spending time with our 3 kids, surfing, working out, playing basketball, traveling, and hiking.

.

We help people with a wide array of financial products and strategies in order to achieve financial freedom and successfully retire without having to dramatically change one's lifestyle or pay a hefty tax bill each year. We do this by setting up guaranteed lifetime income streams and taking key retirement risks off the table.

4 steps to take right now:

1. Get your house in order

Create a Spending plan- Don't spend more than you make. Give your money direction vs just recording where it goes. Get organized.

2. Build on a solid foundation

Have a solid foundation of income and savings. Then when market volatility hits, or a recession takes place, you are on firm financial ground.

3. Amplify your Wealth

This is where you start seeing your wealth grow quickly, because you can literally earn interest on the same money twice. Similar to how banks do fractional reserve lending, but you get the benefits not them.

3. Multiply your Wealth

You're able to generate capital that becomes a source of passive cash flow you can live off of for the rest of your life. This is where you'll truly enjoy financial freedom.

For help with any or all of these steps, contact us or our office to set up a no obligation strategy call.

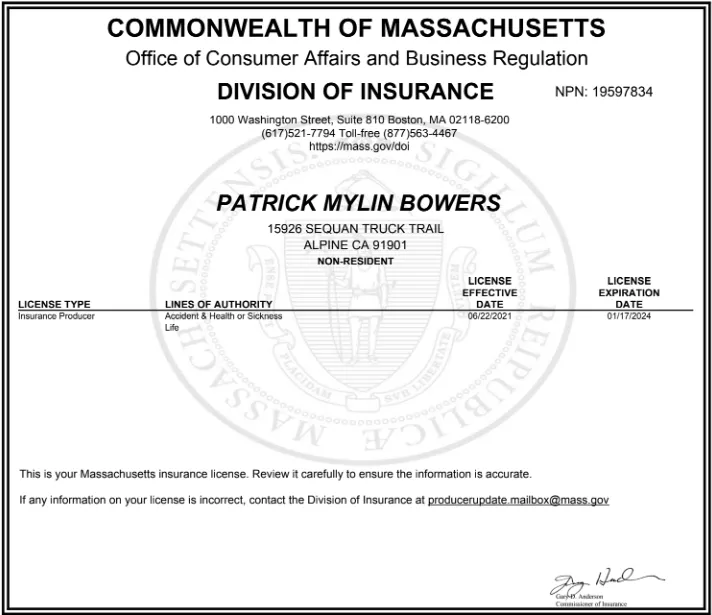

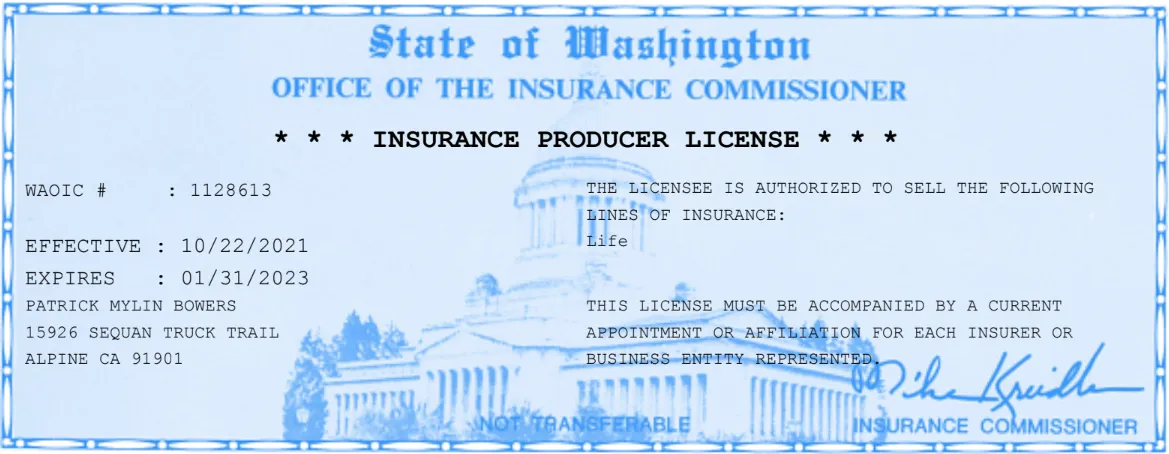

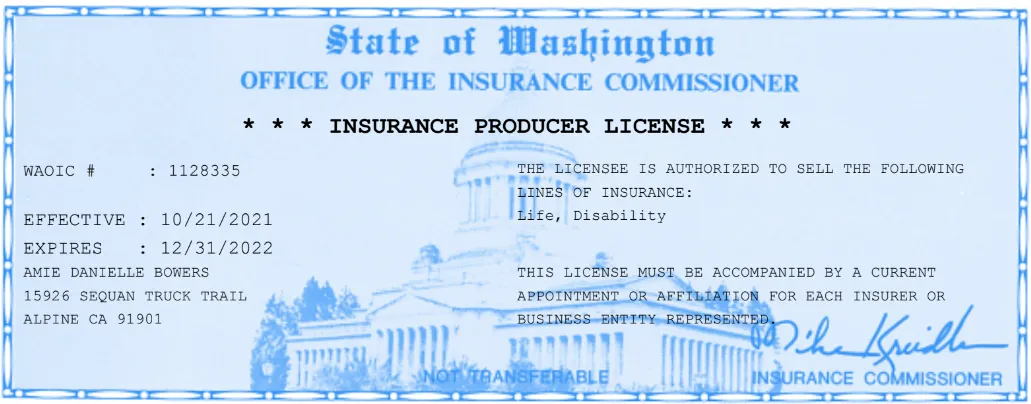

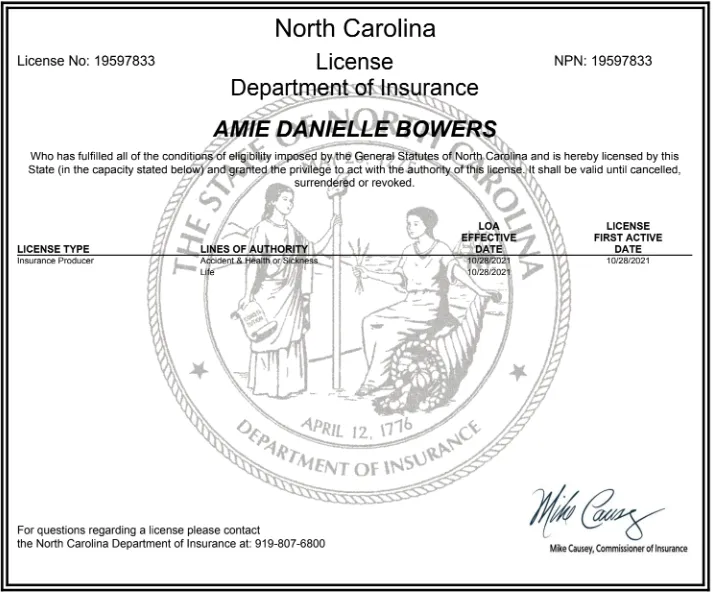

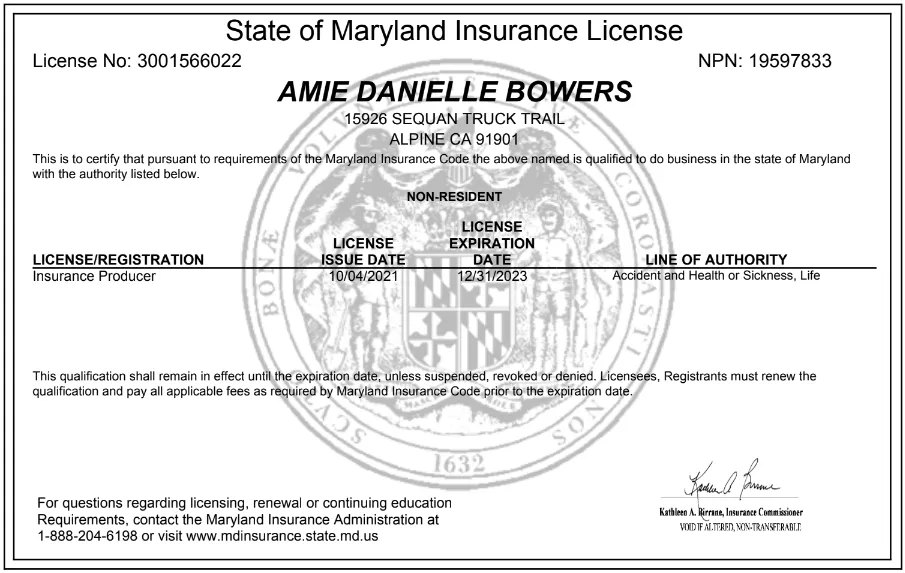

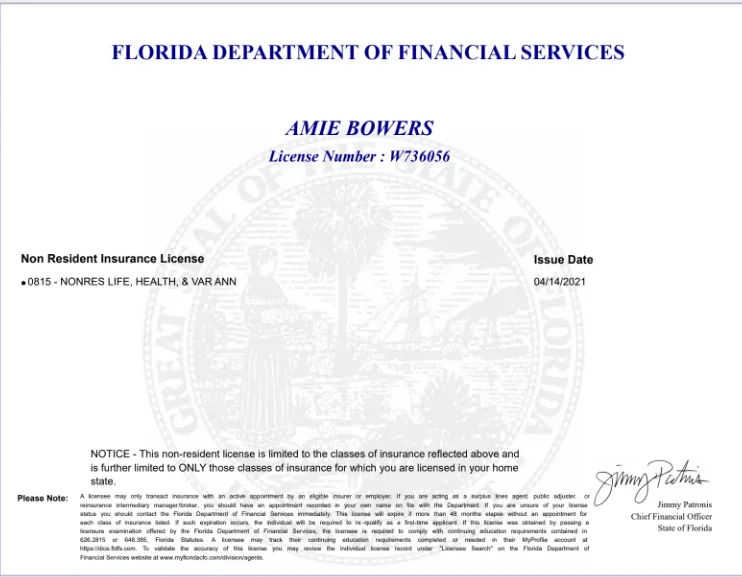

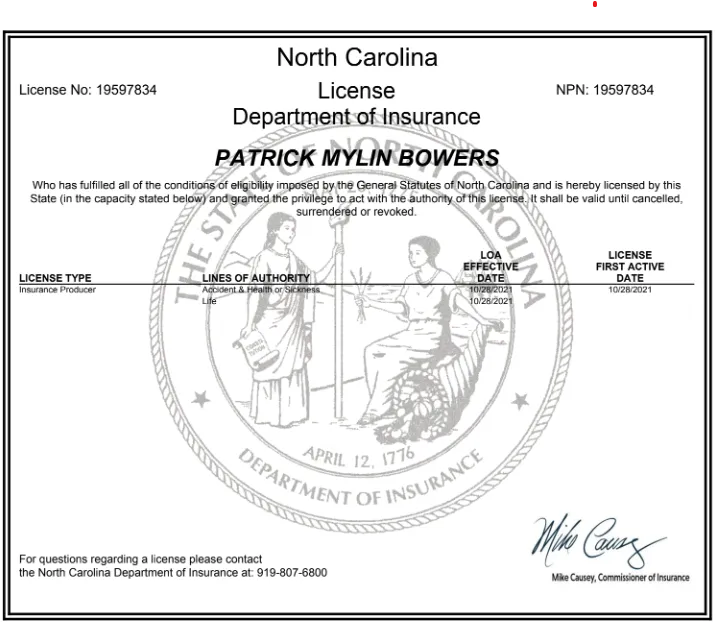

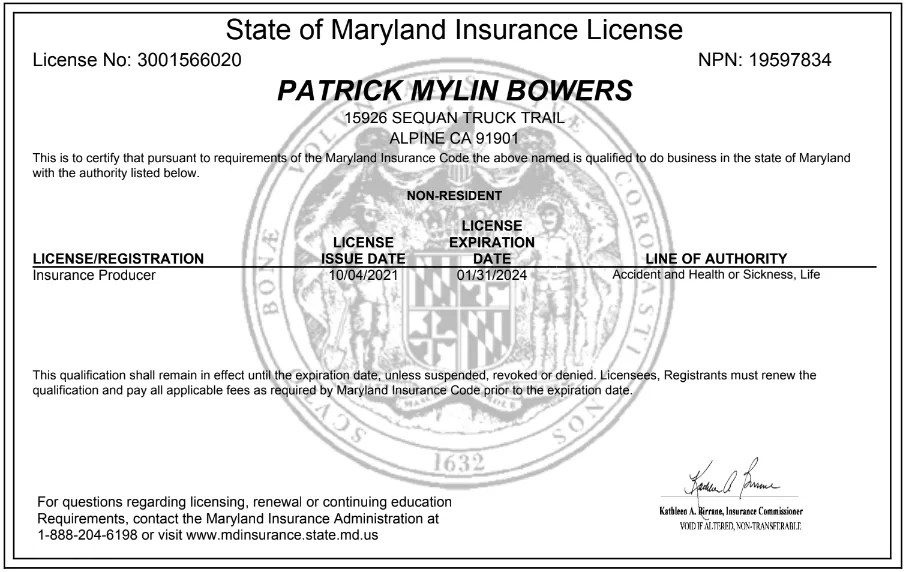

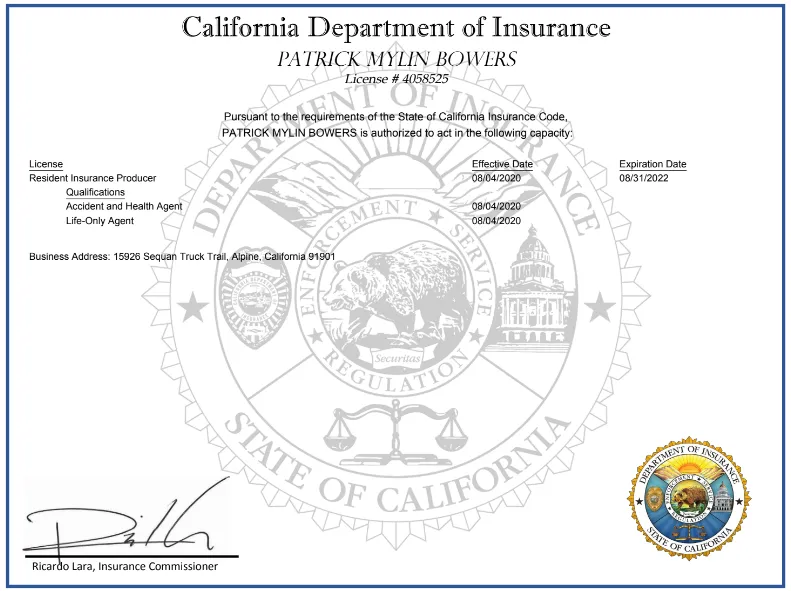

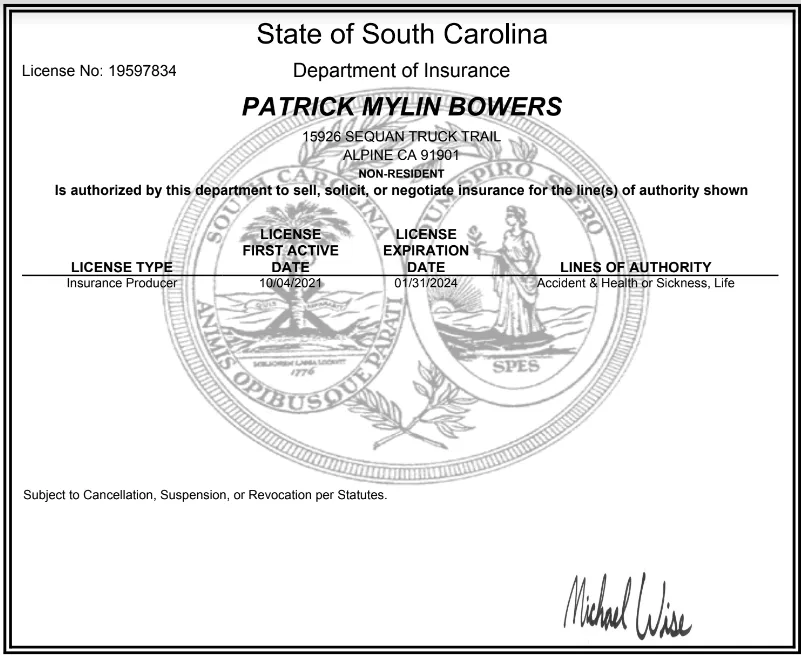

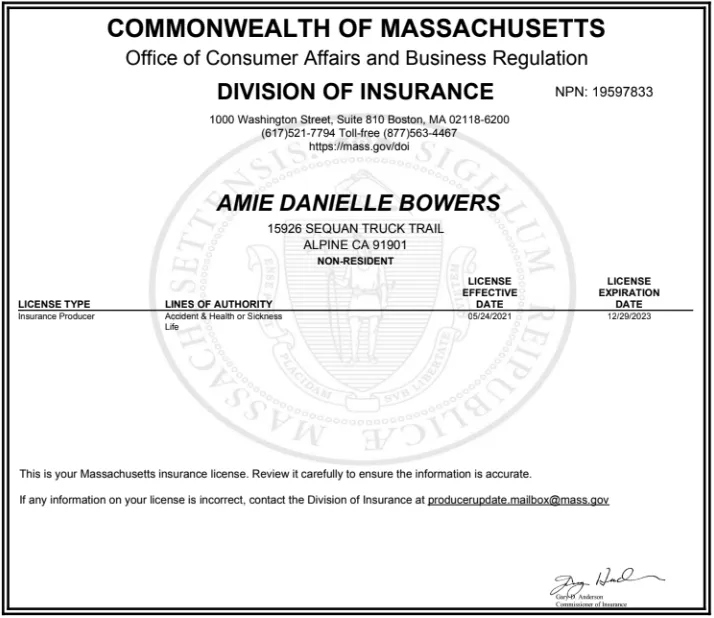

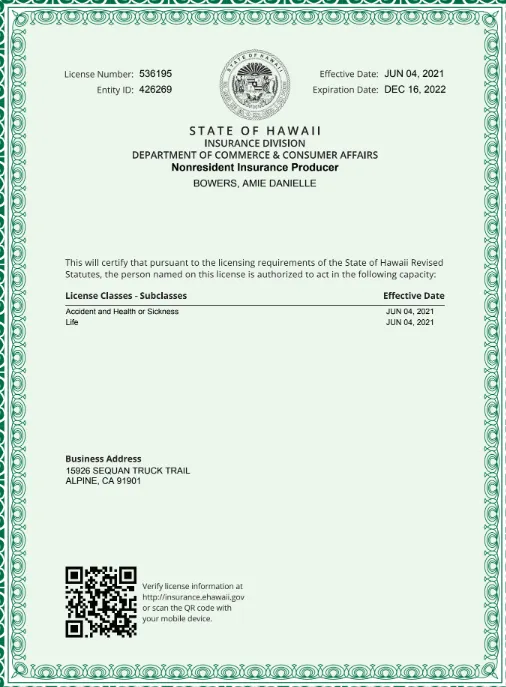

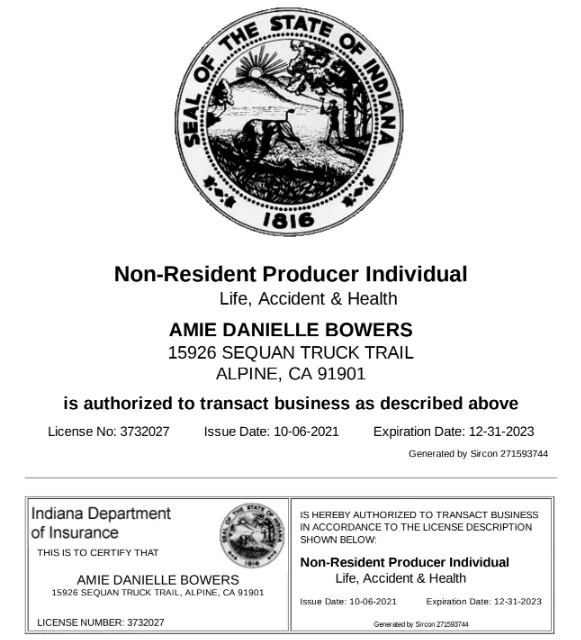

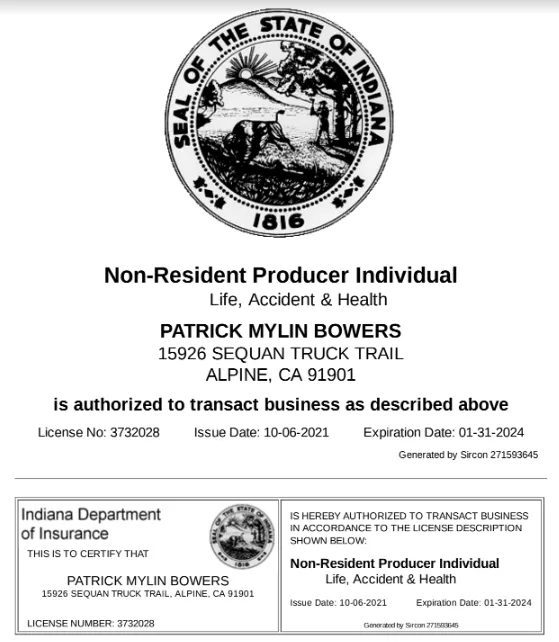

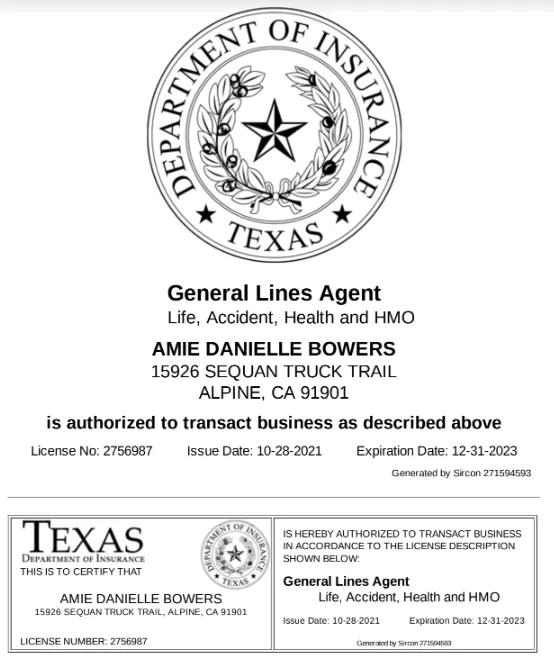

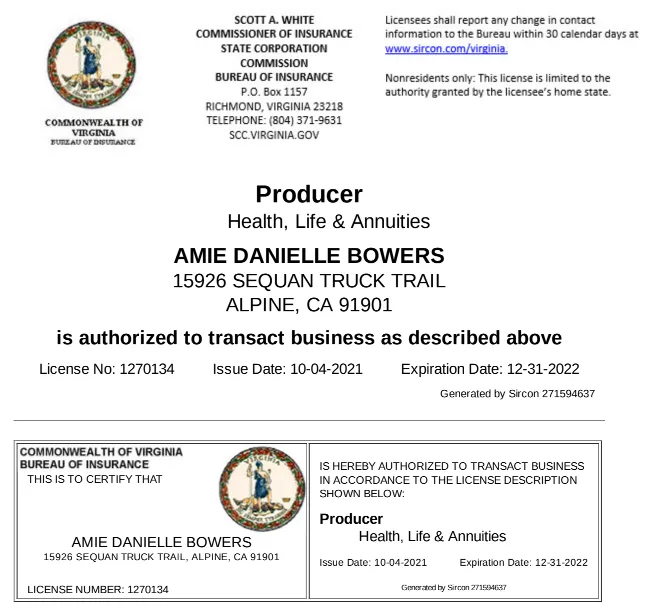

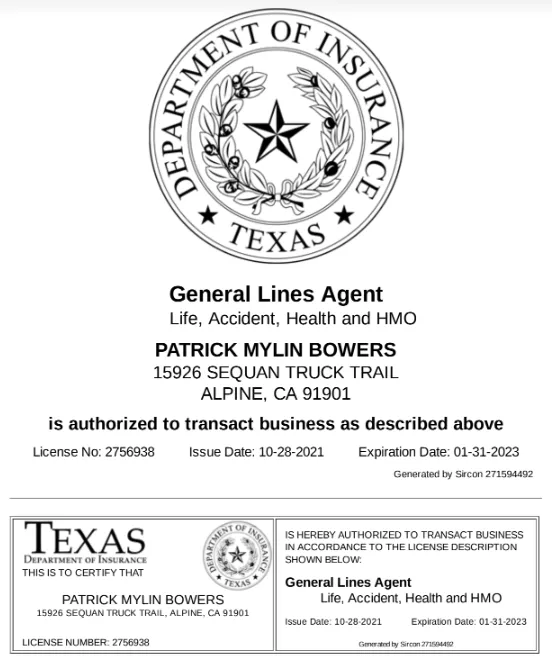

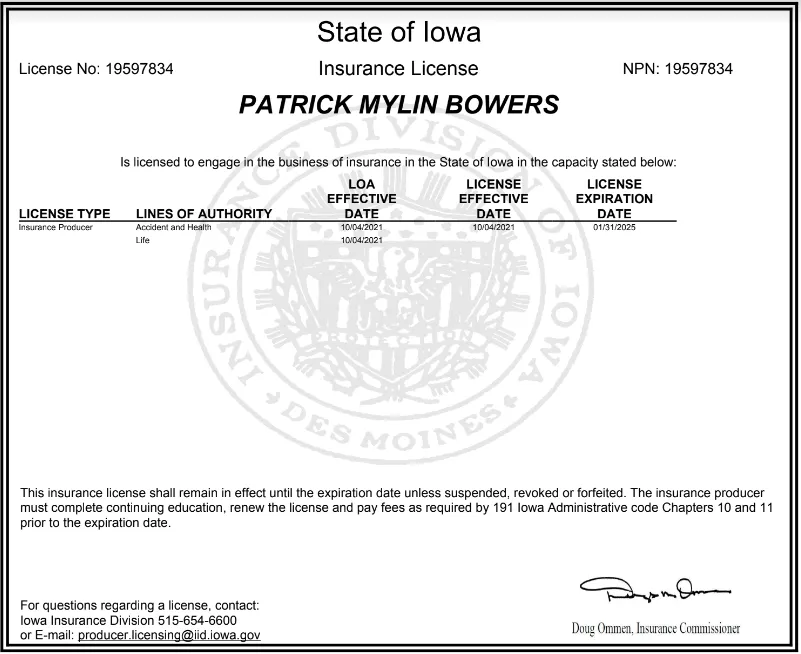

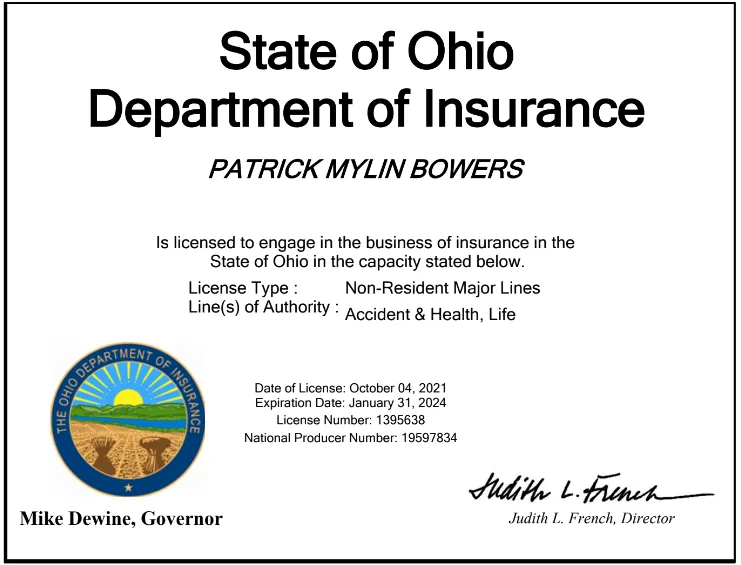

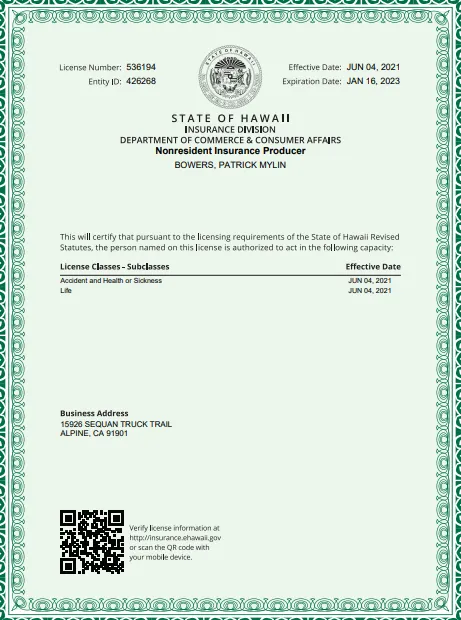

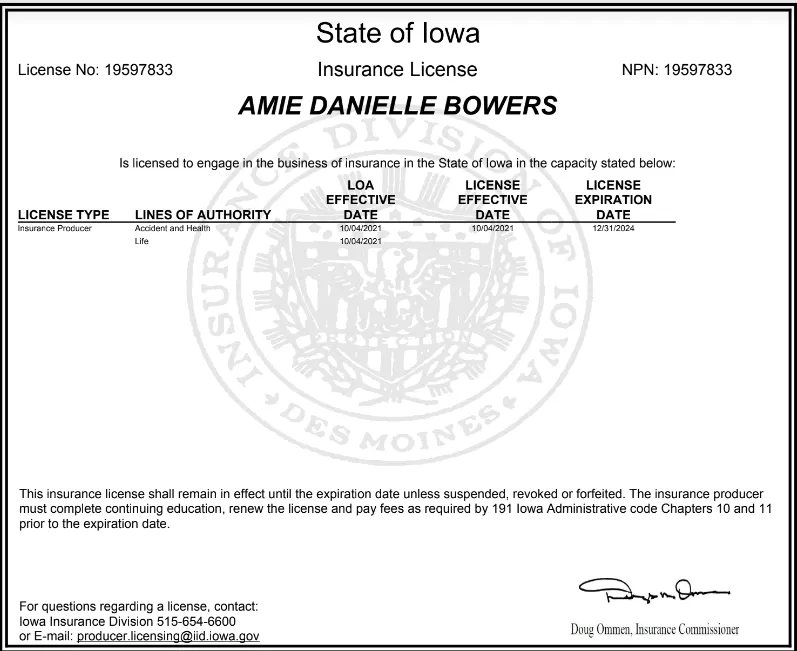

Licenses & Credentials

National Producer #: 19597833 & 19597834

Copyright ©2022 All rights reserved